Rob Sowden of Bournemouth-based consultancy Business Cash Enabler reports a healthy cashback of £110k for a local IT services business as part of the government’s innovation tax incentives.

Rob, innovation tax incentives specialist reports:

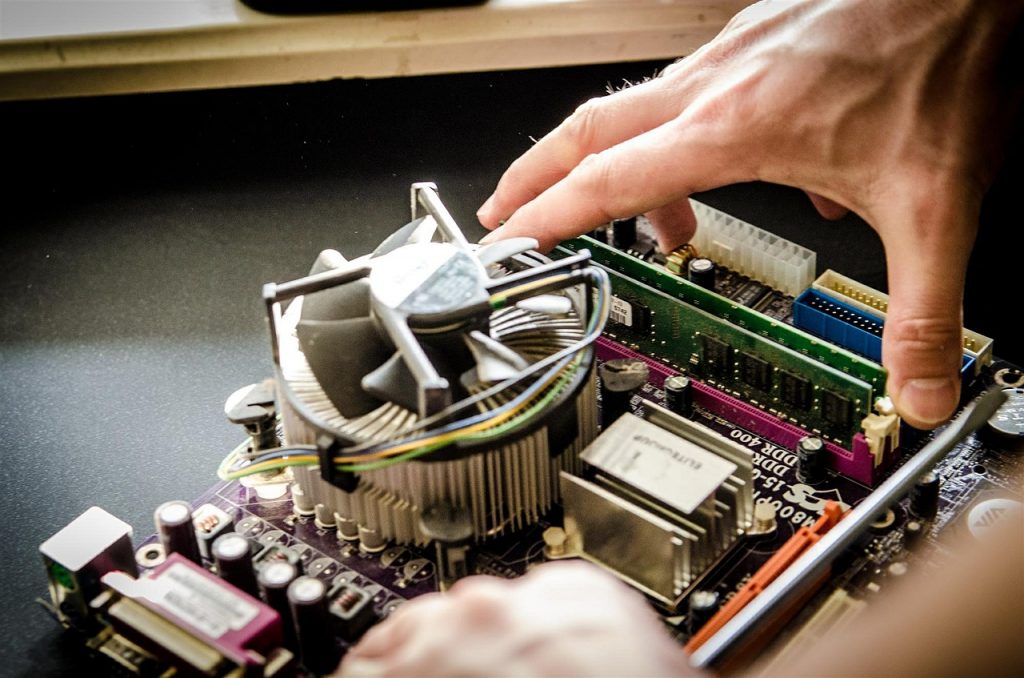

“In less than three years this local business has received £110k cashback from the government for innovative activities. This is an incredible case study, but very typical of what happens. This company does not produce any product but is an IT support business and integrator of third party products. This involves overcoming technical uncertainty which is by definition ‘research and development’, if the activity involves unique innovation. Each year their accountant asked them if they carried out any research and development (R&D) activities and the client answered “no”. This happens often because neither the accountant nor the client understand the full technical scope of HMRC’s R&D tax credits scheme. The scheme was introduced in 2000/01 and this company was incorporated in 2004 and therefore could have claimed each year, however, there is a window of only 2 years for a back-claim. This means the business had likely missed out for a decade on somewhere in the region of £250k free cash prior to the £110k they have received.

“A trading company that carries out any form of unique innovation may qualify for a year-on-year cashback from HMRC under this very generous scheme. A business does not have to be profitable to get this cashback, in fact a loss-making company can obtain an enhanced cashback, up to 33% of qualifying staff costs can be rebated. Some businesses have claimed and received small amounts, maybe £10k or £20k, which is much less than they are entitled to. Many businesses simply don’t believe me when I tell them how much they could be getting, or even that they are even eligible at all. In effect, they are saying no to free cash! As a guide, the average UK SME received £53k for the last reported year. What catches many businesses out is that they believe this claim opportunity is an accountancy work-stream, whereas it is really about technology. The service I introduced this business to required a specialist IT/software analyst to identify all of the qualifying activities permitted within the government’s scheme rules.”

Business Cash Enabler provides a free service to businesses to check eligibility for innovation tax incentives.

www.businesscashenabler.co.uk